United States tariff talks weighed heavily on the Australian share market in February, with the All-Ordinaries index falling by 4.4% to close the month at 8,403.9 points. The Australian dollar remained steady, with 1 Australian Dollar currently buying 62.2 United States cents.

As widely expected, the Reserve Bank of Australia (RBA) board cut the Cash Rate by 0.25% per annum in February, with the Cash Rate now at 4.10% per annum. Most economists do not expect any further cuts from the RBA board until mid-year.

Global share market returns were mixed in February, with the United States Dow Jones Index falling by 1.6%, the London FTSE gaining by 1.6%, the Japan Nikkei 225 falling by 6.1%, and the Hong Kong Hang Seng Index gaining by 13.4% for the month.

The month of February saw United States President Donald Trump continue to dominate the headlines.

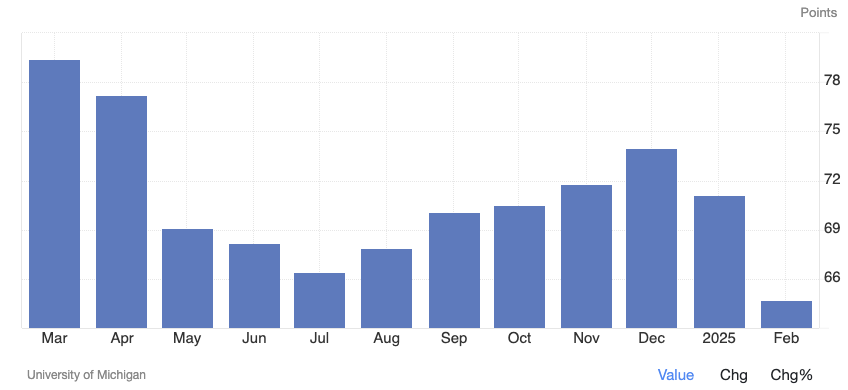

There is also now evidence that Trump’s various threats are starting to hurt the economy. The University of Michigan consumer sentiment survey showed a slump in February due to a rise in inflation fears as shown in the chart below.

Source: tradingeconomics.com

At the end of the month, President Trump labelled Ukrainian President Volodymyr Zelenskyy a “dictator”, unnerving markets a little, as did the surprise announcement of a 25% tariff on cars, pharmaceuticals, and computer chips.

This comes after earlier plans to levy 25% tariffs on Canada and Mexico (which have since been postponed), a 10% additional tariff on China (still going ahead), tariffs on steel and aluminium (though exemptions are possible) and so-called “reciprocal tariffs” in early April after the White House reviews the trade restrictions imposed on the United States.

As expected, volatility in investment markets is heightened on the back of the various trade announcements and with little detail available, reacting to such announcements is somewhat futile for patient long-term investors.

If you have any questions, please contact us on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.