It was a positive start to the year for the Australian share market, with the All-Ordinaries index gaining by 7.7% to close the month at 8,789.7 points. The Australian dollar was steady, with 1 Australian Dollar currently buying 62.1 United States cents.

The Reserve Bank of Australia (RBA) board did not meet in January, with the next RBA board meeting scheduled for mid-February.

Global share market returns were generally positive in January, with the United States Dow Jones Index gaining by 4.7%, the London FTSE gaining by 6.1%, the Japan Nikkei 225 falling by 0.8%, and the Hong Kong Hang Seng Index gaining by 1.5% for the month.

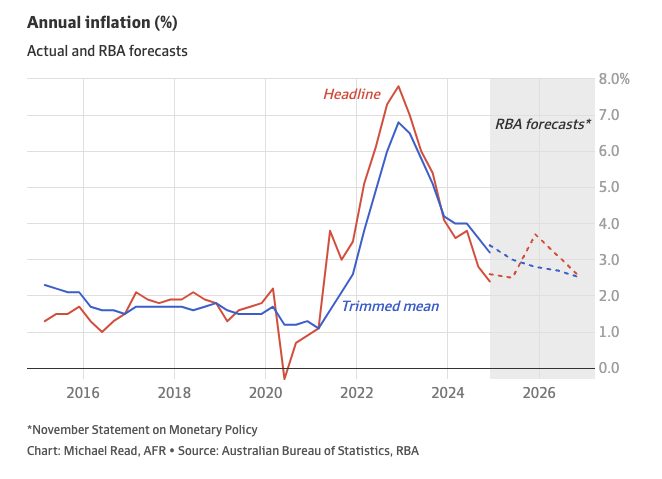

Major economic news in the month was the release of softer-than-expected Australian inflation data in January. Data as represented in the chart below shows underlying inflation fell from 3.6%in September to 3.2% in December – its lowest rate in three years.

Bond markets are now pricing in a 95% expectation that the RBA will rate cut rates when it meets on February 18. Furthermore, bank economists from Westpac, UBS and Citi also brought forward their predictions for the timing of the RBA’s first rate cut to February 18 from May 20.

The prospect of interest rate relief for borrowers coming months ahead of the Federal Election (likely to be in April) would be welcome news for the Federal Government. The RBA has raised interest rates 13 times since May 2022, taking the cash rate (currently 4.35% per annum) to its highest level in 13 years, and marking the fastest tightening cycle in a generation.

As I have written in previous monthly newsletters, share markets have already “priced-in” lower inflation, and by extension interest rates coming down. The latest data suggests that the so called “soft-landing” for the economy from high inflation remains possible.

If you have questions, please contact us on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.