The Australian share market gained 1.8% in the month of August to close at 5,125.3 points. Aussie shares bucked the global trend, as international markets were cautious of the US commencing military intervention in Syria.

The Dow Jones Index fell 4.4%, the FTSE fell 3.1%, the Hang Seng fell 1.8% and the Nikkei 225 fell 2.9% for the month.

In late August, US Secretary of State John Kerry accused Syrian government forces of killing 1,429 people in a chemical weapons attack in Damascus. This has ‘spooked’ investors with US military invention considered inevitable. This, in turn, may lead to unrest in the middle east, higher oil prices….. and so on.

While the events unfolding in Syria have the world’s attention, on the domestic front, all focus will be on the Federal Election held this Saturday. If the betting agencies are any indication, come Saturday evening Tony Abbott will be the next Australian Prime Minister.

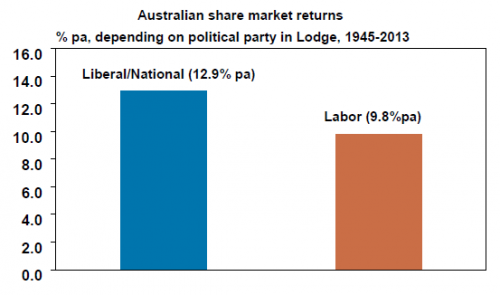

The Liberal Party is relying on its conservative ethos and economic credentials (largely on the back of the Howard-Costello regime). With history as a guide, investors have done well under a Liberal-Coalition government as illustrated in the chart below.

Notwithstanding strong investor returns under a Liberal-Coalition government, the incoming government (if elected as expected this Saturday) will have several economic challenges ahead of them. Over the last week, Tony Abbott has intelligently moved away from the prospect of an immediate Federal Budget surplus.

With the RBA adopting a strong rate easing policy (cutting the RBA cash rate by 25 basis points to 2.50% per annum in August), government fiscal policy ought to complement the monetary policy stance of the RBA.

While I am not one for the ‘cash-handout’ economic stimulus that was part of the Rudd-Swan solution to the Global Financial Crisis, I do believe that targeted government investment in key infrastructure can assist the Australian economy transition its way from the mining investment boom which is already easing (as mentioned in last month’s newsletter).

The problem that Tony Abbott will face is that the economy is already laden with debt, many Australian’s have a ‘sense of entitlement’ in terms of low and middle-class welfare and there are very few government owned enterprises (save for Medibank Private) that can easily be privatised to boost the government’s war chest.

The above issues do not factor the strong possibility that the balance of power in Senate could be held by a mix of the Green’s, Nick Xenophon, Clive Palmer’s Palmer United Party and perhaps even Pauline Hanson. This will make passing legislation incredibly difficult and add to the issues for Tony Abbott to deal with (if elected).

Whatever the election result is on Saturday, the Government will have to carefully work its way through managing the expectations of the Australian public. Put simply, a change of government may not be the panacea to the current set of economic issues that everyone thinks. Nevertheless, I do think that a united conservative Liberal-Coalition government will have a better ability to handle the likely challenges over the next 4 years.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This

article is general information only and is not intended to be a recommendation.

We strongly recommend you seek advice from your financial adviser as to whether

this information is appropriate to your needs, financial situation and investment

objectives.