The Australian share market continued its positive start to 2013, with the All Ordinaries index closing February up 4.5% at 5,120.40 points. Global shares were generally well supported in February with the Dow Jones Index gaining 1.4%, the FTSE gaining 1.3% and the Nikkei 225 gaining 3.8%. The Hang Seng bucked the global trend, declining 3.0% for the month.

With our stock market getting off to a cracking start in 2013 (up 9.8% since December), one wonders if it can continue. In 2012 we started the year in a positive frame of mind only to have several politically inspired crises lead to sharp pull backs in riskier assets. But will this time be different???

Although there is no precise definition of what constitutes a bull market, if this share market rally is the beginning stage of a prolonged equity run, it would be the most unusual bull market in history.

Such extended share market rallies usually start with low share market valuations and are fuelled by significant cyclical earnings growth, sustained capital inflows and widespread price gains across all sectors.

However, resource stocks (which normally lead to market rise as growth prospects improve) have lagged their industrial peers. The current rally has been led by rises in defensive sectors such as financials, telcos and healthcare, even though expected earnings in those stocks have not improved (as investors chasing dividend yield push-up share prices).

While downside risks to the global economy have greatly reduced in the wake of central bank largesse and the ECB stepping up as a lender of last resort in Europe, the market rally at present may be running on thin air.

Although share price growth can temporarily separate from company earnings growth (as it did in 1975, 1982, 1991, 2001, 2009 and 2012), it has never occurred in two consecutive years. Consequently, a recovery in earnings growth is paramount for the market recovery to continue and without it, the market rise may quickly deflate.

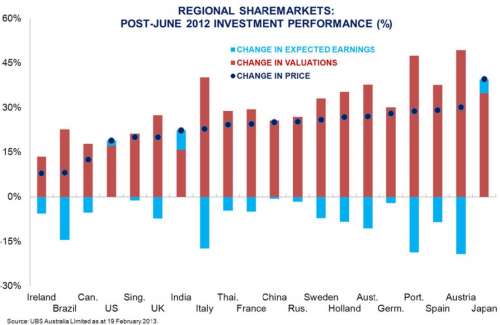

The fact that expected earnings have only risen in three countries (US, India and Japan) since June 2012, suggests that global share markets have become overheated and may be due for a pullback. This is of course unless earnings expectations (or actual earnigs results) show signs of growth.

The RBA board kept rates on hold in February at 3.00% per annum. The RBA board will meet again tomorrow to assess interest rates. The Australian Dollar fell 2.1% in February and is currently buying US102.04 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.