The Australian share market consolidated recent gains with the All Ordinaries gaining 1.2% for the month to close August at 4,339.00 points. Aussie shares have now gained 5.5% for the 2012 calendar year.

Global shares were also generally positive in August, with the Dow Jones Index up 0.6%, the FTSE up 1.4%, and the Nikkei 225 up 1.2%. The Hang Seng fell 1.8% for the month.

During the month we had the comical situation of the Resources Minister Martin Ferguson saying ''you've got to understand, the resources boom is over”. This was hosed-down rather quickly by Prime Minster Julia Gillard telling parliament “the export boom in resources still has a very long way to run”.

Why is this important? If the resources boom is over, then it is a real “game changer” for the Australian economy and the strength of the Australian Dollar.

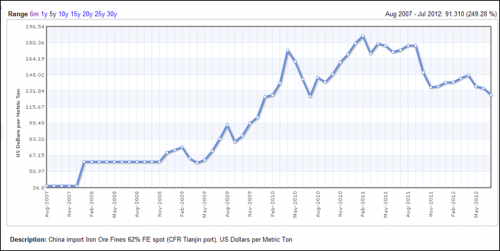

To put this into some perspective, the chart below shows the spot iron ore price over the last 5 years, with iron ore being Australia’s largest export (representing around 20% of all exports).

Source: www.indexmundi.com

While the debate will continue as to how long the resources boom can last, one thing that is cannot be disputed is that fact the spot price of iron ore has fallen sharply over the last year.

Looking at the chart above, clearly there was a ‘boom’ in iron ore prices from 2009. However there has also been a sharp decline in iron ore prices since August 2011.

Given the above change in prices, I would be extremely surprised if the Federal Government can return a surplus for the 2012/13 financial year (due to lower tax receipts from the resources sector). However this doesn’t mean that the boom is over!

Iron ore is used in the production of steel which, in turn, is used in the construction of buildings, roads, railways and other infrastructure. Emerging countries have significantly upped their consumption of steel and are expected to continue to do so into the future.

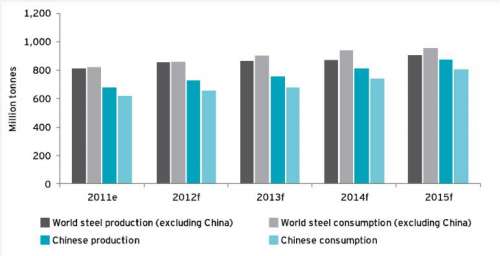

The chart below analyses steel production and consumption both on a global basis and China specific basis.

Source: ABARE

It is evident from the above chart that there is a forecast steady increase in steel consumption (in particular from China) however a relative slow-down in the growth rate of steel production. This is normal as production capacity is relative to expected future consumption.

Provided steel consumption continues to grow, there shouldn’t be an end to the Australian resources boom for a very long time. In this regard, I note that BHP expects China’s consumption of steel to peak in 2025. Rio Tinto is more bullish expecting China’s steel consumption to peak in 2030. Either way, this is another 13 to 18 years!

In interest rate news, the RBA board will meet tomorrow to discuss rates. Most economists are predicting rates to remain on hold at 3.50% per annum. However, there is a growing groundswell of support for another cut before Christmas.

The Australian Dollar fell 1.4% in August and is currently buying US103.31 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.