The Australian share market closed June flat at 4,135.5 points. Global shares were positive (following a rally late on Friday) with the Dow Jones Index up 3.9%, the FTSE up 5.0%, the Nikkei 225 up 5.9% and the Hang Seng up 4.4% for the month.

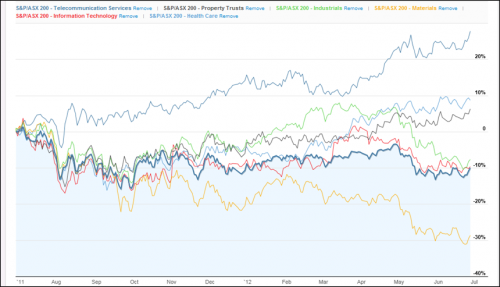

June signalled the end of the Financial Year in Australia – a poor one for share market investors – with the Australian share market down over 11%. The chart below shows the sector performance of the Australian share market over the 2011/12 Financial Year.

Source: Core Equity Services

As shown above, the best performing sectors were telecommunications (+25%), healthcare (+9%) and property trusts (+5%). These were the only sectors to record positive price growth. The worst performing sector was materials (aka resources), down nearly 30% for the 2011/12 Financial Year. It is somewhat counter-intuitive for the worst performing sector to be materials amidst a ‘resources boom’.

Notwithstanding that it was the end of the Financial Year in Australia; all attention was on Greece in June. The Greek election was run with the pro-austerity New Democracy party invited to form a coalition government. World leaders, financial markets and European authorities all breathed a collective sigh of relief with the result, with the anti-austerity ‘left leaning’ Syriza party coming in second.

In a strange twist, the total vote of the anti-bailout parties (46.2%) was higher than the pro-bailout parties (41.8%), but the largest party (the ND) is awarded 50 extra seats under Greek rules for having more votes that anyone else.

In a further positive sign for financial markets, late Friday (after the Australian market was closed) European leaders at a two-day summit in Brussels said they would speed plans to create a single supervisor for the euro zone's banks.

It was agreed at the summit that the euro zone's bailout funds should be able to directly boost the capital of struggling banks, without adding to government debt. This resulted in some of the largest daily gains in overseas markets for the year.

Before we get carried away that it is happy days again, several concerns remain in relation to Europe...

Last month alone ratings agency Moody's downgraded 28 Spanish banks, Spanish and Italian bond yields rose to critical levels, Cyprus became the fifth country to officially request assistance from Europe and Greece's finance minister resigned with exhaustion after five days in the job!

With this backdrop, it is difficult to see how world leaders can come up with a sustainable solution to deal with the mountain of debt issues. With no end in sight, fundamental indicators such as dividend yield and price-earnings ratios are not driving short-term share prices. Investors will need to remain patient and take a long-term view, cashing their dividend cheques along the way.

In domestic interest rate news, the RBA board decided to cut the cash rate by a further 25 basis points to 3.50%. The RBA board meets again tomorrow to discuss interest rates.

The Australian Dollar rebounded nearly 6% in June. The turnaround was driven by the positive events offshore, with the Australian Dollar currently buying US102.46 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.