Each month I seem to be writing the same thing.... more volatility due to European sovereign debt issues! Again the political posturing in Europe weighed on the performance of the Australian share market.

The All Ordinaries Index fell 4.0% to close November at 4,184.70 points. However, three substantial economic developments announced in quick succession last night may see the Australian share market recover the majority of its November losses today.

On Wednesday morning Europe time, central banks around the globe announced a co-ordinated plan to make funding cheaper for European banks. The announcement came after China indicated it would loosen monetary policy by lowering the reserve requirement ratio for banks. In addition, a report on the US labour market showed private-business employment had the largest monthly gain this year.

Given the developments overnight, global share markets had mixed performance in November with Dow Jones Index gaining 0.8%, the FTSE falling 0.7%, the Nikkei 225 falling 6.2% and the Hang Seng falling 9.4%.

It was a big month of political developments, even setting aside the news in the last 24 hours. Italy’s Prime Minister Silvio Berlusconi resigned in awkward fashion and was succeeded by well regarded economist Mario Monti (who was appointed rather than elected).

Prime minister-designate Mario Monti then attempted to appoint a cabinet comprising both sides’ Italian politics. Unfortunately the major parties distanced themselves from the new Prime Mister, in a bad sign to investors.

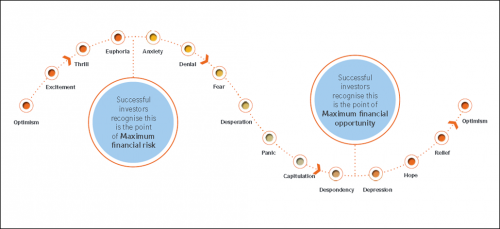

With so much market volatility, it is an important time to remind ourselves of the ‘cycle of investor emotions’. The chart below was published by Russell Investments in an attempt to explain how investors react and the optimum time to invest.

The above chart attempts to illustrate that often the best time to invest is when it feels the worst. This is summarised well by one of the most successful investors of all time, Warren Buffet, who famously said ‘we simply attempt to be fearful when others are greedy and to be greedy when others are fearful’.

No doubt there has been significant ‘fear’ of late. Many in the media have suggested that the events in Europe will lead to a long and protracted new Global Financial Crisis. It is important to note that the Australian sharemarket has already fallen sharply this year, and in my view the majority of the downside as already been factored into share prices. Whilst there may well be some more short-term downside, we know that when things turnaround this tends to happen very quickly.

The Australian dollar was battered around in November, dropping below parity before rallying late in the month to finish at US102.14 cents to 1 Australian Dollar.

The RBA board cut interest rates in November by 0.25% per annum. The RBA board meet again next week with most economists tipping the RBA cash rate to remain unchanged at 4.50% per annum.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.