With the recent poor sharemarket performance it is only natural for investors to be fearful and think about switching assets away from shares into cash.

However, by moving now from shares into cash is shortsighted and doesn’t take into account the big picture and long-term benefits of investing in shares.

On a long-term basis, notwithstanding the recent poor performance, shares have proven to provide a growing income stream. Cash deposits only hold their value; therefore cash investors face a significant risk of inflation eroding their returns.

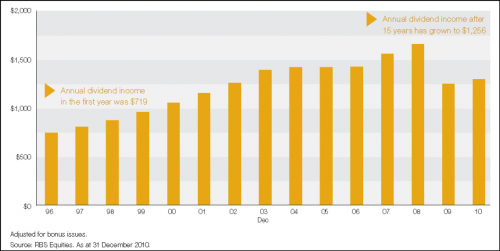

The chart below shows the growth in income with $10,000 invested in NAB shares since 1996.

As shown above, the NAB dividend income started at $719 per year although after 15 years this grew to $1,256 per year. This is an increase of nearly 75%!

If you chose the defensive cash option back in 1996, you would earn interest income 15 years later of around $475 (i.e. $781 per year less than the NAB dividends). Additionally, share dividend income is favorably taxed via franking credits whereas cash interest is 100% taxable.

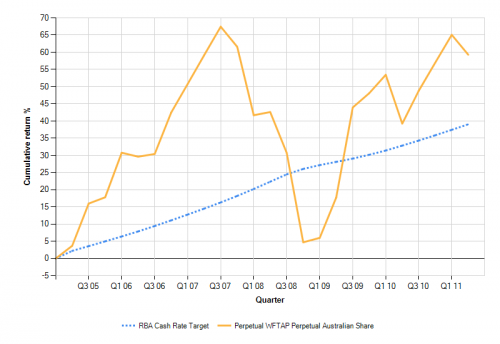

The media tends to only focus on share price and in doing so we can lose sight of the income benefits shares can provide. The chart below shows a comparison between a large cap Australian Share Fund with distributions reinvested (Perpetual Australian Share Fund) and the RBA Cash Rate since 2004.

As shown above, the Perpetual Australian Share Fund has outperformed the RBA Cash Rate over the period by an extra 20% in cumulative return. This is notwithstanding the advent of the Global Financial Crisis and subsequent significant share market correction in 2007 and 2008.

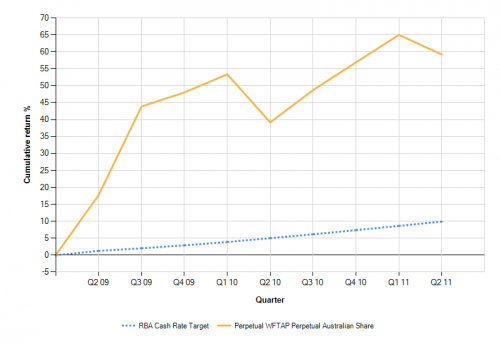

If you change the return date to start at 1 July 2009 (when the Australian sharemarket was at 3,934 points - broadly the same level as today) the outperformance principally due to higher income with shares is rather staggering.

Therefore the moral of the story is that shares are still a compelling investment class for investors, provided you have the time to ride out the current market volatility.

If you would like any further information, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.