It wasn’t the best start to the year for investors as a weakening global economy continued to take its toll on the world’s major share markets. And it was a similar story here in Australia, with both our share market and our dollar losing ground amid concerns that we’re headed for our first recession since 1991.

At a glance

-

Global share markets tumble in the first month of 2009

-

Oil and other commodity prices continue to fall as demand tapers off

-

Australian share market closes lower on mounting recession concerns

Global share markets weaker

Global share markets got off to a rocky start in 2009, with all the major indices taking a hit in January amid further evidence that the world economy is undergoing a significant slowdown. In the US, the economy shrank the most since 1982 in the December quarter after consumer spending, which accounts for more than two-thirds of the US economy, posted its worst slide in the post-war era. Corporate earnings there also slumped, highlighted perhaps by Ford Motors’ massive US$5.9 billion loss in the final quarter of 2008 – the worst in the company’s 105-year history.

But the bad news wasn’t limited to the US. In the UK, economic growth fell 1.5% in the same period, and China was also markedly weaker, expanding at its slowest pace in seven years thanks mainly to falling exports. Not surprisingly, similar declines are also expected in Europe and Japan over the coming weeks.

In the US, the benchmark S&P 500 Index fell 8.6%, despite a brief rally around the inauguration of new President Barrack Obama, while markets in Europe (-8.7%), the UK (-6.4%) and Japan (-9.8%) also closed the month significantly in the red1.

Oil prices fall yet again

Oil prices posted their seventh consecutive monthly decline in January, closing at just US$41.68 a barrel on the back of rising stockpiles and weaker demand. Since hitting a record high of US$147 a barrel in July last year, oil prices have now fallen 72%, and they may yet fall even further as the world economy continues to slow.

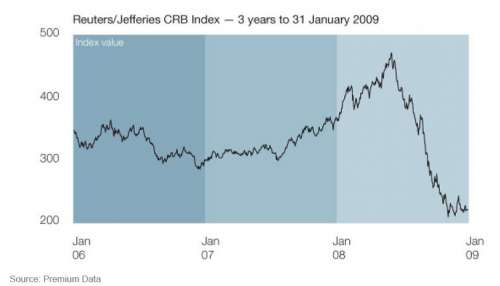

But oil isn’t the only commodity to have been affected by the global slowdown. Prices for gold, corn, soybeans and wheat have also dropped considerably as demand for raw materials tapers off. Below is the Reuters/Jefferies CRB Index, a widely used measure of the performance of global commodities, which shows the slide in commodity prices in the last six months.

Bonds yields rise

Global bond yields were generally higher in January, despite the ongoing slowdown in the global economy. In the US, the yield on US 10-year bonds rose2 63 basis points to close the month at 2.84% on speculation that new President Barrack Obama will increase borrowing to record levels in order to pay for his proposed economic rescue package. Here in Australia, it was a similar story, with bond yields rising 11 basis points to close at 4.10%.

Australia market falls amid recession fears

The Australian share market fell for the fifth month in a row in January, with the S&P/ASX 200 Accumulation Index closing 4.9% lower amid rising unemployment and concerns that the economy is headed for its first recession since 1991. The unemployment rate rose to 4.5% in December – its highest level in almost two years – as mining companies, airlines, and car manufacturers were all forced to cut staff. On top of that, a number of Australia’s Asian trading partners, particularly China, are struggling at the moment and were now beginning to see the impact of that on our own economy.

Importantly, though, Treasurer Wayne Swan has already said that he won’t hesitate to stimulate the economy further should the need arise, noting that the government could add to the A$45 billion it’s already spent on stimulus measures if conditions here continue to deteriorate.

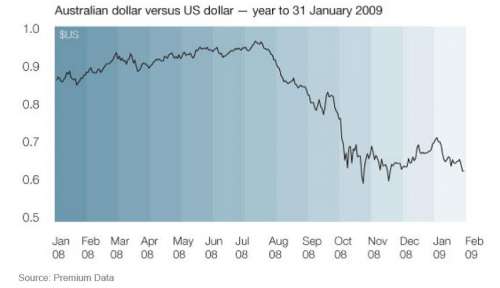

The Australian dollar slumps 10%

The Australian dollar (A$) fell 10% against the US dollar (US$) in January, giving up all of last month’s gains as weaker commodity prices and a resurgent US$ combined to push our own currency lower. Since its high of US$0.9849 cents back in July last year, the A$ has now fallen 36% against the US$. It’s difficult to imagine any sort of sustained recovery in the near-term if global growth remains weak and commodity prices continue to trend lower.

Looking ahead

The outlook for the global economy hasn’t got any better in the last month. It seems that the world’s biggest markets, notably the US, Europe and Japan, are very much in recession and this is beginning to have an inevitable knock-on effect everywhere else. The short-term outlook for global share markets remains a little uncertain, particularly as company profits look set to fall even further on the back of the slowdown in the world’s major economies. However, there is still little doubt that shares have been very oversold in recent months, which means they continue to represent good value for investors with a long-term view.

In Australia, it would seem that we’re now very much on the brink of recession. The economy expanded at its weakest pace in eight years in the September quarter and with unemployment on the rise there’s a good chance that GDP figures for the December quarter will show negative growth.

Importantly though, inflation – which had been a major problem for the Reserve Bank for much of last year – now seems to be coming under control. This was evident in early February when the Bank cut a full 1.00%, taking the official cash rate to just 3.25%.

Disclaimer and Disclosure

This publication has been prepared and issued by BT Financial Group Pty Limited ABN 38 087 480 331. While the information contained in this document has been prepared with all reasonable care no responsibility or liability is accepted for any errors or omissions or misstatement however caused. All forecasts and estimates are based on certain assumptions which may change. If those assumptions change, our forecasts and estimates may also change.___________________________________

1 European shares measured by the Dow Jones Eurostoxx 50 Index, UK shares measured by the FTSE 100 Index and Japanese shares measured by the Nikkei 225 Index

2 Bond yields have an inverse relationship with bond prices, meaning that when yields fall, prices rise and vice versa.