Share markets around the world posted a solid month in December capping off an otherwise flat year.

The All Ordinaries Index gained 3.6% to close the year at 4,846.9 points. Global markets also recorded solid monthly gains in December with the Dow Jones Index gaining 5.2%, the FTSE gaining 6.7%, the Hang Seng gaining 0.1% and the Nikkei 225 Index gaining 2.9%.

The full calendar year was one marked by further uncertainty as Governments (in particular in Europe) came to terms with the aftermath of the Global Financial Crisis. A bailout of Greece in the second quarter of 2010 was backed up with further Euro zone economic woes in Ireland in the last quarter of 2010.

For the full 2010 calendar year the Australian share market fell 35.8 points, or 0.7%.

As we enter 2011 there is no end in sight to Europe's woes and subsequent fears of the follow-on effect to global credit markets. The EU has finally put an emergency fund in place. Is it big enough? Well that will be the story for 2011.

China, of course, is never far from the headlines. The juggernaut continued to roll-on in 2010 consuming raw materials for steel production at record rates. This all played out well for the Australian resources sector.

I am reasonably bullish on the prospects for the Australian share market in 2011. Looking back, the Australian share market is still some 40% off its high in November 2007.

Whilst there have been several structural changes to debt markets over the last few years, Australian companies appear to have well and truly turned the corner.

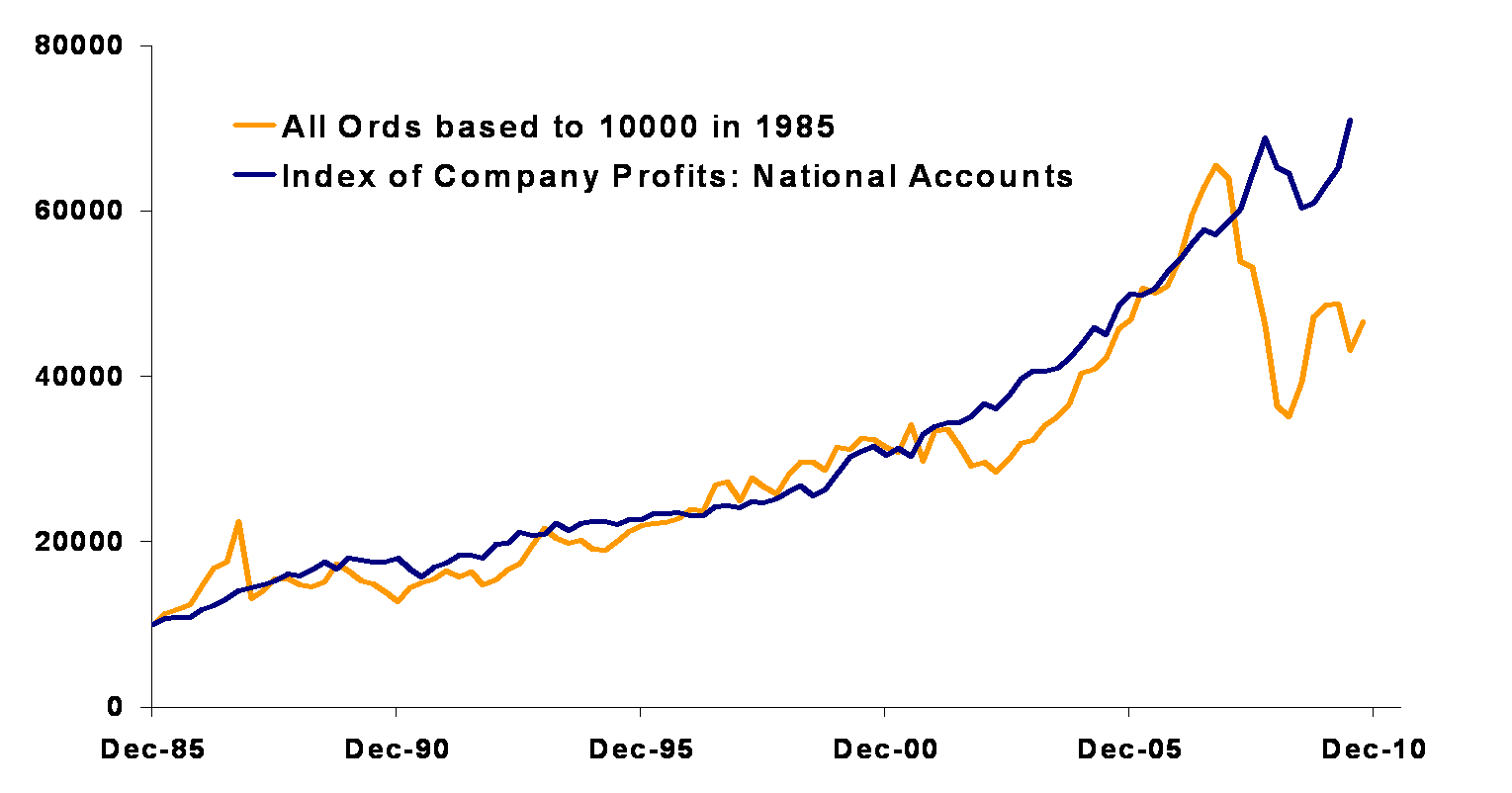

The chart below compares an index of Australian company profits with the Australian share market as measured by the All Ordinaries Index.

Over the long-term it is reasonable to assume that a company’s share price growth should reflect the level of profit the company generates. As noted in the chart above, there is now a rather large divergence between profit growth and share price (as measured by the All Ordinaries Index).

Over time, I expect this divergence to ease through growth in share prices. Hopefully this will take place with strong growth in 2011.

The Australian Dollar looks likely to remain strong in the short-term and may creep as high as US1.05 cents to the dollar over the next few months. Although, many predict a long-term value for the Australian Dollar to be around the US0.75 to US0.85 cents mark.

2010 saw a steady flow of interest rate increases. The official cash rate now stands at 4.75% per annum. I expect a further 0.50% in increases throughout the later part of 2011.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.