The Australian share market is on track to close the month of September 1.90% higher, with the All-Ordinaries index currently at 8,472.7 points. The Australian dollar has further strengthened this month, with 1 Australian Dollar currently buying 68.80 United States cents.

Global share market returns have been generally stronger throughout the month, with the United States Dow Jones Index gaining by 1.5%, the London FTSE falling by 1.1%, the Japan Nikkei 225 gaining by 1.2%, and the Hong Kong Hang Seng Index gaining by 14.5% for the month so far.

The Reserve Bank of Australia (RBA) board once again kept the Target Cash Rate on hold at 4.35% per annum at its September meeting (despite the United Stated Federal Reserve cutting interest rates in the United States by 0.50% per annum during the month).

While the RBA board has remained steady over the last few months, the 5-year bond rate in Australia has dropped significantly as shown in the chart below.

Source: Trading Economics

The 5-year bond rate gives an insight into market expectations of future interest rates. Interest rates cuts are clearly now “priced-in” to the bond market in Australia. Given this, it seems to be a waiting game as to “when” not “if” the RBA board will cut the official Target Cash Rate.

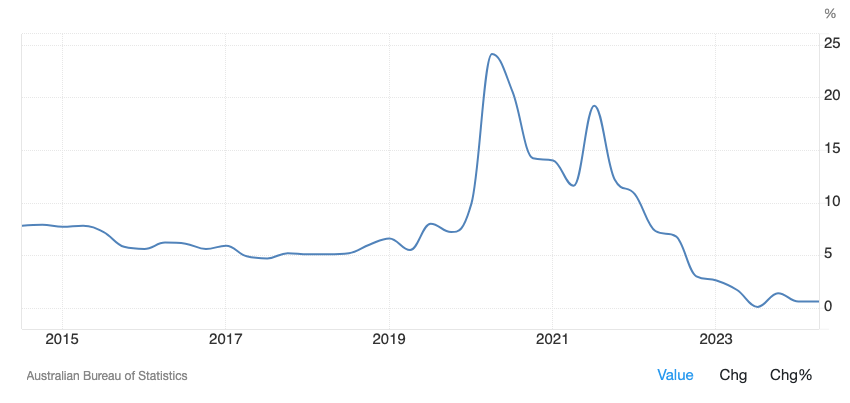

The high-interest rate policy setting (and high cost of living) has dramatically impacted the household saving ratio in Australia as highlighted in the savings ratio below.

Source: Trading Economics

With the savings ratio now at the lowest level since the Global Financial Crisis, it is further evidence that there is scope for the RBA board to lower interest rates sooner rather than later.

As noted in previous monthly newsletters, lower interest rates will be good for investment markets (provided the RBA is not too late in making a move).

If you have questions, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.