The Australian share market closed the month of May 0.5% higher, with the All-Ordinaries index closing at 7,970.8 points. The Australian dollar gained by 2.7% over the month with 1 Australian Dollar currently buying 66.55 United States cents.

Global share market returns were positive in May, with the United States Dow Jones Index gaining by 2.3%, the London FTSE gaining by 1.6%, the Japan Nikkei 225 gaining by 0.2%, and the Hong Kong Hang Seng Index gaining by 1.8% for the month.

The Reserve Bank of Australia (RBA) board kept the RBA target Cash Rate on hold at 4.35% per annum in its May meeting. However, continued higher-than-expected inflation has caused most to delay expectations of a cut in the RBA target Cash Rate until next year.

During the month, the Federal Government handed down its Federal Budget for the 2024/25 financial year.

As expected, Labor’s third Budget was filled with measures aimed at easing the cost of living, with energy bill relief supplementing Stage three tax cuts. The economic creditability of providing “handouts” when the RBA board is waiting for inflation to come down is highly questionable however, the Federal Government is positioning itself for an election (and both sides of politics adopt such measures).

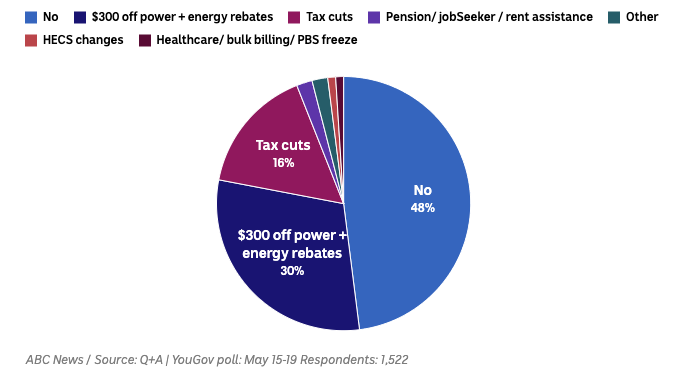

The chart below shows the responses of 1,522 participants to a YouGov poll question: "Can you name one specific thing in the federal government's 2024-25 budget that will make you personally financially better off after July this year?"

From my perspective, it is somewhat of a surprise that for Centrelink recipients the social security “deeming rates” will stay at their current levels for a further 12 months (despite interest rates having increased significantly in recent times).

Arguably the "deeming rates" impact only those "wealthier" Centrelink recipients, and with the RBA target cash rate at 4.35% per annum, the upper deeming rate of 2.25% per annum seems odd. Less surprising are the proposed increases to Commonwealth Rent Assistance, and more flexibility for Carer Payment recipients.

Superannuation was largely left unchanged in the Budget, although the Treasurer announced plans to pay 12% Superannuation Guarantee on government-funded Paid Parental Leave.

For small businesses, the Federal Government announced it would extend the $20,000 small business instant asset write-off by 12 months until 30 June 2025.

If you have any specific questions in relation to the Federal Budget, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.