It was a tumultuous month for financial markets with fears that a collapse of the European Union will lead to a further liquidity crisis throughout the developed world. The Australian share market fell 7.5% to close May at 4,133.7 points, giving back nearly all of the gains made this year.

Global share markets were equally impacted with the Dow Jones Index falling 6.2%, the FTSE falling 7.5%, the Nikkei 225 falling 10.3% and the Hang Seng falling 11.7% for the month.

European debt concerns and austerity measures are not new, so why has the market reacted so strongly? Firstly, there were some key political issues to emerge in France and Greece. Secondly, it became apparent that the state of the banking sector in Spain is dire.

In early May, French voters elected Socialist Party candidate Francois Hollande as their new president. Mr Hollande is an opponent of spending cuts to address the euro zone's sovereign-debt issues. At the same time, Greece voters rejected austerity policies backed by the two incumbent parties, leading to the calling of a further election in Greece set for 17 June.

The forthcoming Greece election will be seen as a referendum on whether Greece will remain in, or exit, the EU. It seems to be a 50/50 call as to what will happen. Therefore, investors ought to be aware of the consequences of Greece exiting the EU in the near term.

If Greece backs away from its agreed austerity cuts and loses European financial aid, they will run out of money in early July 2012 (or sooner if tax revenue if less than expected). This will see Greece bankrupt and they will either have to leave the EU on their own terms, or be ‘kicked-out’.

Greece leaving the EU is not necessarily a bad thing. One of the benefits of Greece leaving the EU is that the value of their currency will dramatically fall, thereby making their exports (e.g. tourism) and labour costs competitive on a world scale. At present, the existence of the Euro currency is one of the major drags to a sustained economic recovery.

Whilst (in theory) there can be a positive case mounted for Greece exiting the EU, as this has never been attempted and there is no process in place for such a development, it may lead to short-term chaos. The level of chaos will depend on how well the Greek government can reinstate a new currency, close/covert the banking sector from the Euro, and ensure that the Greek people don’t smuggle their existing Euros out of the country (i.e. strict boarder controls will be required to stop people trying to flee with their savings).

Adding to the above issues in Greece, the banking sector in Spain is in desperate need of a liquidity injection to strengthen its bank balance sheets. However, were can such an injection of capital come from? It would seem that the Government is not the long-term answer.

In light of the above issues, portfolio asset allocation has become increasingly difficult. If we look to history for guidance, the closest parallel we can draw from a 'debt-boom' followed by a 'debt-bust' is Japan post World War II.

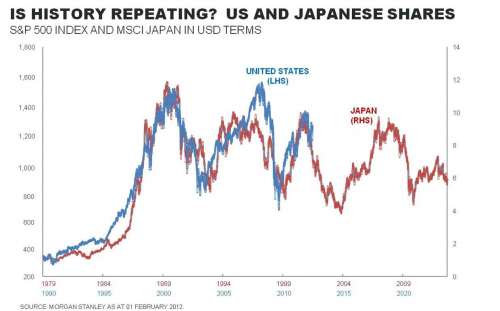

The chart below plots the performance of the Japan share market from 1979 and shows the correlation to the US share market from 1990 (with the US share market being representative of all major global share markets at present).

As shown from the above chart, there are some staggering similarities between the Japan share market in the early 1990's and the current day performance of the US share market.

Notwithstanding the above, it is important to note that with interest rates falling, there is still a strong case for holding shares in a long-term investor’s portfolio. This is mainly due to the strong dividend yield and natural hedge against inflation (a key risk as Government's attempt to inflate away thier debt).

Aussie shares such as Westpac, Myer, Tabcorp, Telstra, QBE, AMP and so on are all returning 8%+ grossed up dividend yield based on current share prices. The key issue when allocation your assets towards shares is to ensure that you have time on your side to whether the short-term volatility. Also, remember that the media only reports on share prices – not dividend income!

A switch to investors focussing on income rather than capital growth is not something new (refer previous Market Wrap articles). However, it seems that with the debt laden global economy we are set for a period of ‘sideways’ trading.

In domestic politics, the Federal Budget was announced in May (refer article Federal Budget Update 2012). It must be said, that with the above economic outlook and falling commodity prices, the notion of the 2012/13 Federal Budget actually being in surplus is nothing more than fantasy.

In interest rate news, the RBA board cut interest rates by 50 basis points to 3.75% during May. The RBA board meets again next Tuesday to discuss interest rates.

The Australian Dollar fell over 7% in the month May on the back of falling interest rates and commodity prices. The Australian Dollar is currently buying US96.71 cents.

Finally, a reminder about changes to the private health insurance rebate effective 1 July. Singles with income over $84,000, and families with income over $168,000 may be able to benefit from the higher private health insurance rebate by prepaying their private health cover for 12 months in June.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.