It was an uneventful month for the Australian share market. Aussie shares were relatively flat in March, gaining 0.7% to close at 4,420.0 points. Global markets were mixed with the Dow Jones Index gaining 2.0%, the FTSE falling 3.3%, the Nikkei 225 gaining 3.7% and the Hang Seng falling 5.2% for the month.

The Australian share market is struggling for direction as stronger economic data from the United States is offset by persistent debt concerns in Europe. The key question is whether the emerging economies (in particular, China) can continue to stimulate world economic growth.

During the month BHP Billiton, Australia's mining giant, warned that China's demand for iron ore will flatten as the world's second-largest economy cools. Surprisingly this news had little impact on the share market. China’s GDP growth target now stands at 7.5%, an eight-year low but nevertheless very strong.

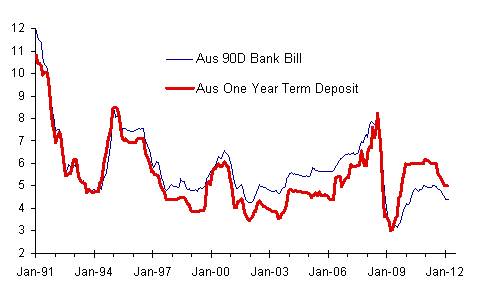

Against this backdrop of mixed economic news, the share market has performed admirably. One reason why shares are a compelling investment is because the alternatives for investors are looking worse. The chart below shows term deposit interest rates since 1991.

Source: RBA, Morgan Stanley Smith Barney

The one year term deposit rate has fallen by 115 basis points in the last year alone, with many forecasters expecting interest rates to continue to decline in the near term. The term deposit rate is currently around 5.5% for one year (however the variances between banks are significant). In comparison, Australian shares currently offer a dividend yield of around 6.5% per annum (adjusted for franking credits).

Whilst on a valuation perspective the case for investing in shares (over term deposits) is very compelling, there are still downside risks in the global economy (in particular that the Euro crisis will spin out of control). Therefore investor timeframe is a critical consideration when assessing term deposits or shares.

Nevertheless, investing in shares for income has become major focus. I expect this trend to continue into the future as ‘baby boomers’ pursue those investments that can provide higher levels of retirement income. I note that the number of people aged over 60 is expected to triple over the next 40 years, meaning that longevity is a key risk when considering the allocation on your investments.

The RBA board met today, again keeping rates on hold in April. The RBA cash rate is currently 4.25% per annum.

The Australian Dollar weakened by around 2.7% in March as concerns of slowing GDP growth in China emerged. The Australian dollar is currently buying US104.46 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.