The Greek debt crisis played havoc on the Australian sharemarket in June, before recovering strongly on the last two trading days with news that Greece’s parliament passed a further round of austerity measures.

The All Ordinaries Index fell 2.7% to close June (and the 2010-11 financial year) at 4,659.80 points. I note that the All Ords was down as much as 5.5% during the month, before staging a strong late month recovery. For the full financial year, the All Ords had a positive 3.4% return.

Global sharemarkets were mixed in June with the Dow Jones Index falling 1.2%, the FTSE gaining 2.7%, the Hang Seng falling sharply by 5.4% and the Nikkei 225 gaining 2.1%.

As it is the start of a new financial year, it’s as good a time as any to look into the ‘crystal ball’ and see what is predicted for the months ahead.

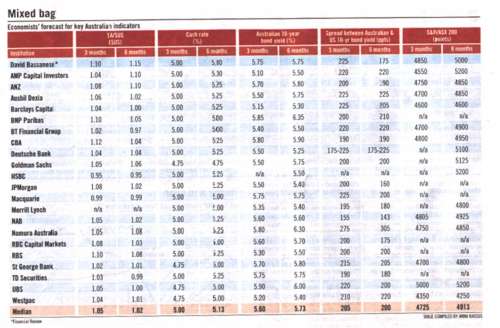

The table below published in the Australian Financial Review on 27 June 2011 contains the results from a survey of leading economists, with their predictions for key economic indicators over the next three and six months.

Economist expectations point to a positive outlook for Australian shares. The three month median forecast for the Australian sharemarket is a gain of 2.5%. Over the next six months, the median forecast is a gain of 6.6% from its current levels.

Importantly, all institutions (other than Westpac) are predicting a positive six monthly outlook for the Australian sharemarket. With several institutions predicting six monthly gains in excess of 12%.

Other forecasts of note are interest rates. Interest rates are predicted to rise – with most economists predicting an increase within the next three months. Many economists are predicting two more rate rises before the end of the calendar year.

The Reserve Bank of Australia left interest rates on hold in June. The RBA board meet again next Tuesday.

The Aussie dollar is also predicted to remain relatively stable for the next three months before falling toward the end of the year. The dollar is currently buying US107.02 cents to 1 Australian dollar.

Finally, July 1 marks the start of the flood levy. The flood levy only applies is you earn over $50,000.

If you have a taxable income of $50,000 or less in the 2011-12 financial year, you will not be charged the flood levy. The table below contains details of the flood levy.

|

Taxable income |

Flood levy on this income |

|

$0 to $50,000 |

Nil |

|

$50,001 to $100,000 |

Half a cent for each $1 over $50,000 |

|

Over $100,000 |

$250 plus 1c for each $1 over $100,000 |

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.