It was a strong end to the month for the Australian share market, with the All-Ordinaries index closing the month of July 3.8% higher at 8,013.8 points. The Australian dollar fell by 2.1% for the month for the month, with 1 Australian Dollar currently buying 65.42 United States cents.

Global share market returns were once again mixed in July, with the United States Dow Jones Index gaining by 4.4%, the London FTSE gaining by 2.5%, the Japan Nikkei 225 falling by 1.2%, and the Hong Kong Hang Seng Index falling by 2.1% for the month.

The Reserve Bank of Australia (RBA) board did not meet in July, with the next RBA board meeting scheduled for next Tuesday.

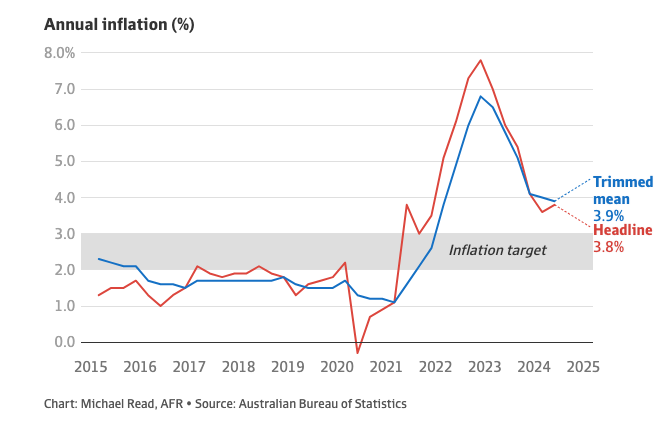

The Australian share market rallied late in the month after Australia’s core inflation measure came in below expectations, prompting traders to rapidly abandon bets of an interest rate increase from the RBA next week.

Trimmed inflation, which is the RBA’s preferred measure of inflation, declined to 3.9% on an annual basis in the June quarter (while core inflation came in at 0.8%).

Markets are now implying a 40% chance of a RBA rate cut in November, and a rate cut almost fully priced in by February 2025. This is a dramatic turnaround from before the inflation data was announced whereby markets were pricing in a 20% chance of an increase in the RBA Cash Rate next week.

In the United States, the Federal Reserve chairman Jerome Powell hinted that the central bank is looking seriously at rate cuts. This news instantly drove the United States share market higher, as confirmed by the strong return for the month.

If you have any questions, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.