The Australian share market had its best start to any year since 1994, with the All Ordinaries Index gaining 5.2% for the month of January (closing the month at 4,325.7 points).

Aussie shares outperformed most major global markets in January – a trend I expect to see continue throughout 2012. Global shares performed well with the Dow Jones Index gaining 3.4%, the FTSE gaining 2.0%, the Nikkei 225 gaining 4.2% and the Hang Seng gaining a staggering 10.6% for the month.

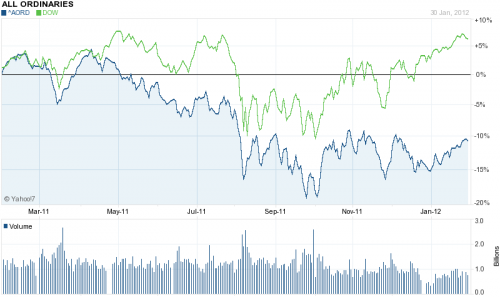

The chart below shows the relative 12 month historical performance of both the Aussie share market (measured by the All Ordinaries Index) and United States sharemarket (measured by the Dow Jones Index).

As shown above, since May 2011 the Aussie share market has lagged behind the United States. As written previously, the higher dividend yield provided from Aussie shares and the strength of the Australian economy relative to the United States (with low unemployment and low government debt) would suggest that Aussie shares ought to have outperformed. This clearly has not been the case.

The reasons behind the stronger performance of the United States share market are bewildering. Some suggest that a strong currency has turned offshore investors away from Aussie shares. Although with declining interest rates around the world and the strong yield on offer from ‘blue-chip’ Aussie shares, perhaps January was the start of a reversal to this recent trend.

Whilst January was a good month for the share market, we are by no means in the clear. Over the coming days and weeks Australian companies will enter into their reporting cycle. Most analysts are tipping poor earnings results. Actual results remain to be seen, however the earnings season usually means more market volatility.

The sovereign debt crisis in Europe is no nearer to being resolved. A meeting between European leaders in Brussels in late January yielded no agreement over how Greece would receive its next bailout instalment. Greece is still trying to reach a deal on a ‘debt-swap’ with private bondholders. Meanwhile, Germany would like the Greek government to relinquish partial control over the country’s budget before receiving bailout help. So the saga continues...... thankfully for the time being global share markets aren’t flinching.

I retain my view that Aussie shares, in particular, can provide a good investment for investors with a long-term time horizon. However, investors will need to be prepared to whether the ‘bumps’ along the way as European leaders negotiate bailout terms and the mixed United States economic data continues.

Those investors with a long-term time horizon will be rewarded handsomely with the Aussie share market currently offering an income return (dividend yield) of approximately 8% per annum (adjusted for franking). This is well above the current rate of term deposit interest.

To interest rate news, the RBA board will meet next Tuesday. Many economists tip a reduction to interest rates – however the key question will be whether or not banks will pass on this cut in full. With global pressure on bank funding, there is an argument that banks will need to continue to increase their margins.

The Australian Dollar also bounced back in January and is currently buying US106.25 cents. With the United States Federal Reserve intent on keeping interest rates at record lows, and assuming that Asian demand for commodities continues, it is hard to make a case for the Australian Dollar falling any time soon.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.