The Australian share market continued its strong start to the year, gaining 1.1% to close April at 4,467.2 points. Global markets were mixed with the Dow Jones Index flat, the FTSE gaining 1.0%, the Nikkei 225 falling 5.6% and the Hang Seng gaining 2.6% for the month.

The Australian share market has now gained more than 8% for the year. So what has changed in investors’ minds? Given the same risk issues (Europe, US growth/debt and China slowdown etc.) that have dominated markets for some time are still very much with us.

It seems that the enormous amount of liquidity being pumped through the global financial system, coupled with a greater confidence that European debt contagion can be contained, is turning investors’ attitudes from "risk-off" to "risk-on".

However, in this new world of heightened market volatility, we know that investor’s moods can change quickly. Although, for the time being at least, it seems that the risk of a sharp fall in share prices has dissipated.

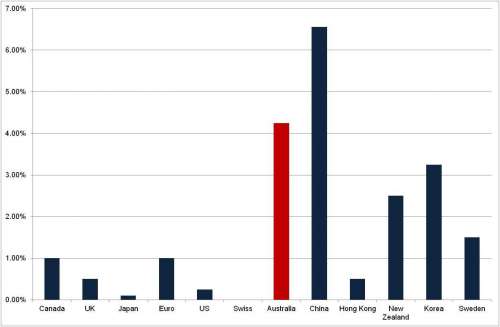

The main talking point in financial markets is interest rates, with the RBA board widely tipped to cut interest rates at 230PM (EST) today. The chart below shows the central bank interest rates for the major global economies.

Source: FXstreet.com

As shown above, Australia currently has the second highest central bank interest rate only behind China (an economy experiencing rapid economic growth). Whilst a rate cut is expected, whether or not any cut will be passed in full onto borrowers is questionable. More and more we are seeing banks control interest rates movements outside the RBA.

A major focus in the month ahead will be the Federal Budget announced on the 8th of May. The government has already foreshadowed changes to superannuation for high income earners. A separate update detailing all relevant announcements will be provided following the Budget.

The Australian Dollar was steady in April and is currently buying US104.28 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.