The Australian share market consolidated recent gains in September, increasing 1.8% for the month to close at 5,217.7 points. Aussie shares have now increased by nearly 12% for the calendar year – an excellent result on the back of a solid end to the 2012 calendar year.

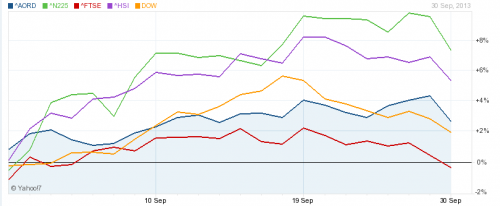

Global shares (in particular Asian markets) were all well supported in September with the Dow Jones Index gaining 2.2%, the FTSE gaining 0.8%, the Hang Seng gaining 5.2% and the Nikkei 225 gaining 8.0% for the month.

During the last week of September investors around the world have been nervously awaiting a deal from US Congress over the “Obamacare” health reforms (with markets dipping late in the month as shown in the below chart).

Source: Yahoo Finance

Concerns have emerged as the Republican-led House of Representatives are seeking to delay Obamacare for a year in return for securing funding of the federal government beyond 30 September.

President Barack Obama must sign a new budget by midnight today (2:00pm AEST) to keep the US government working. If the new budget is not signed, this will trigger a shutdown of non-essential US government services. Mr Obama has refused to negotiate over his health care reforms and says he will veto any amended bill with the backing of the Democrats, who control the US Senate.

In a government shutdown, spending for functions considered essential continues. However, workers in non-essential services are temporarily stood down. Consequently, tens of thousands of US government workers are preparing to stay home until US Congress can reach a resolution.

Of perhaps more concern is that this standoff may be a precursor to the next big US political battle – a bill to increase the government's borrowing authority. Failure to increase the $16.7 trillion “debt ceiling” by mid-October would force the US to default on some payment obligations.

Over the past few years, investors have become increasingly comfortable with such political posturing. I note that global share markets have remained relatively strong in the face of the first US Government shutdown since 1996. There is a generally accepted view that this will not be a “doomsday” situation and that at some point in time a deal will be reached.

Nevertheless, October may still present a difficult month for investors despite the long-run recovery story in the US remaining sound with a stronger labour market and company profits on the rise.

In domestic news in the month, Tony Abbott was elected as Prime Minster and the Liberal Coalition to Government in a widely expected outcome. The RBA kept the cash rate on hold at 2.50% per annum and the Australian dollar strengthened to US93.20 cents to 1 Australian dollar.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This

article is general information only and is not intended to be a recommendation.

We strongly recommend you seek advice from your financial adviser as to whether

this information is appropriate to your needs, financial situation and

investment objectives.