The Australian share market retreated marginally over the month of October, with the All-Ordinaries index falling 0.6% to close the month at 8,422.1 points. The Australian dollar reversed its recent trend, falling 4.4% over the month, with 1 Australian Dollar currently buying 65.80 United States cents.

Global share market returns were weaker in October, with the United States Dow Jones Index falling by 1.0%, the London FTSE falling by 2.1%, the Japan Nikkei 225 falling by 0.1%, and the Hong Kong Hang Seng Index falling by 0.9% for the month.

The Reserve Bank of Australia (RBA) board did not meet in October, however despite headline inflation returning to the RBA target 2% to 3% range in October, most economists are expecting the RBA board to once again keep the Target Cash Rate on hold at 4.35% per annum when they meet next week.

The 2024 United States Presidential election between Vice President Kamala Harris and former President Donald Trump remains the focus of investment markets. As we head into the final stretch of the election campaign, betting markets lean toward a Trump victory.

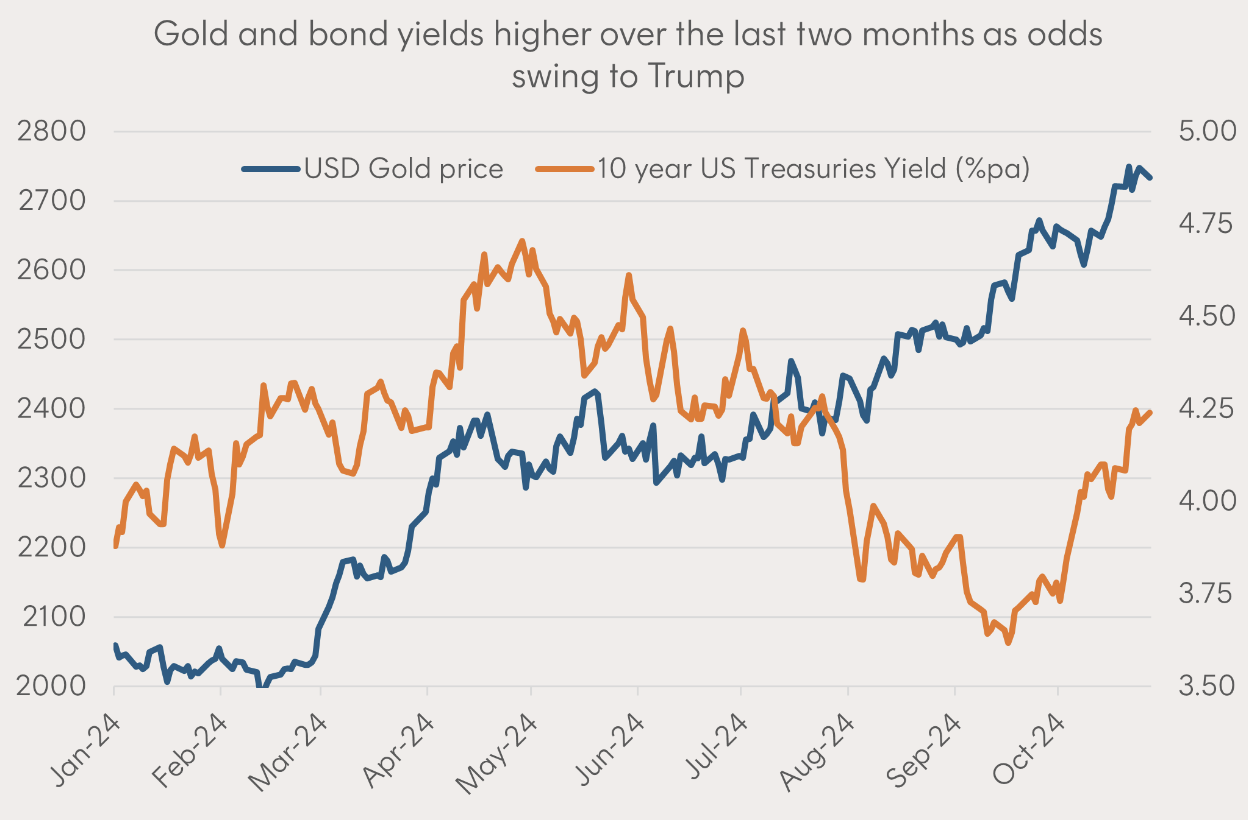

As highlighted in the chart below, bond yields and the gold price have surged in recent weeks. This is a sign that markets are pricing in a greater likelihood of inflation and larger United States budget deficits with the Trump policy platform.

Source: Betashares

While both political parties’ policies will lead to additional United States Government debt, the ability of either candidate to implement their tax and fiscal policy will be dependent on the balance of power in Congress.

Much will be made over the next week of the ramifications of United States election, and investment markets will no doubt be volatile. However, it is important to remember that in the longer term, investment markets are more beholden to macro-economic fundamentals than politics.

If you have questions, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.