The Australian share market had another stellar month, increasing 3.9% in October to close at 5,420.3 points. The positive result came as investors breathed a collective “sigh of relief” after US Congress agreed to an eleventh hour temporary increase to US Government “debt ceiling”.

Global shares also performed well in October, with the Dow Jones Index gaining 2.8%, the FTSE gaining 4.2% and the Hang Seng gaining 1.5%. The Nikkei 225 bucked the trend, falling 0.9% for the month after gaining a whooping 8.0% in September.

The US political scene was the focus in October. In what can only be described as several weeks of political brinkmanship, chaos and confusion, the US government reopened for business. Consequently, 3 million government employees went to the office (and were paid) with the US debt ceiling lifted until February 2014 (when the whole issue will be revisited again).

Even though the outcome of political negotiations came out as markets had expected, one has to wonder what lasting impact constant political wrangling will have on consensus views about US denominated debt. No matter what the view, it cannot be positive and ratings agency Fitch has already placed the US on “review”.

Notwithstanding the recent US political concerns, the stock market rally lives on. While the Australian share market is still some 20% below its all-time high in 2007, it is interesting to note that when including the reinvestment of dividends, the Australian market is now at all-time highs.

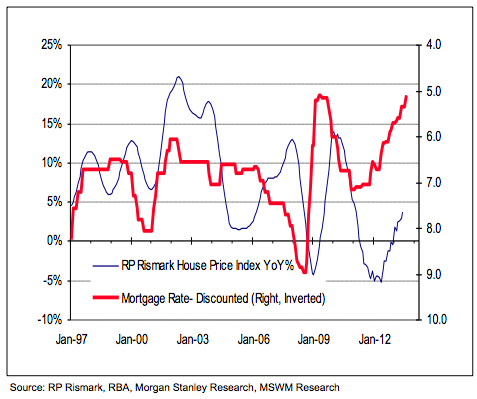

The Australian property market too is performing strongly on the back of historically low interest rates. The chart below shows the historical correlation between interest rates and house prices.

As illustrated above, historically, house prices have been highly correlated to interest rates. Although in more recent times, interest rate cuts have not been met by a commensurate increase to the house price index. The raw data would suggest that further house price increases are to come.

Perhaps price increases are already occurring in some markets, with Sydney property prices increasing strongly year-to-date. Substantially lower interest rates have made property significantly more affordable compared to 2007/08. Although, home-buyers are aware that these historically low interest rates will not last forever, and are clearly using more caution.

The RBA kept the cash rate on hold in October at 2.50% per annum, with several economists now changing their view that the bottom of the rate cut cycle may be near. Interestingly, all the big four banks increased some of their fixed rates over the last month.

The Australian dollar strengthened marginally in October to 94.61 US cents to 1 Australian dollar.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.