The Australian share market recorded another month of gains. The All Ordinaries increased by 2.9% to close October at 4,535.40 points. However, investors showed caution with low trading volumes due (in part) to the upcoming presidential election and hurricane Sandy in the United States.

Global shares were mixed as a result of the above issues with the Dow Jones Index falling 2.7%, the FTSE gaining 0.7%, the Nikkei 225 gaining 0.1% and the Hang Seng gaining 3.7% in October.

On 6 November, the next leader of the largest economy in the world will be determined. Up until hurricane Sandy, the US presidential election campaign has been dominated by economic policy issues. This is a good thing!

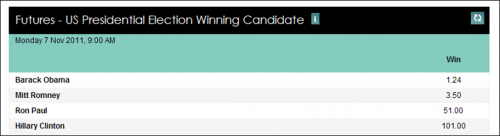

While the bookies have Barack Obama as a short-priced favourite (see graphic below), whoever is elected as President will face a tough task of ensuring that the US can continue to fight its way back from recession.

Source: www.tomwaterhouse.com

To domestic economic news, during October Treasurer Wayne Swann announced the Government’s Mid-year Economic and Fiscal Outlook (MYEFO). The timing of MYEFO was seen by many as a desperate move to keep the targeted budget surplus in check.

There was much speculation in the lead-up to MYEFO that detrimental changes would be made to some existing superannuation rules. However, MYEFO includes very few changes to superannuation – the most important and beneficial being that the Government will provide certainty that where a superannuation pensioner dies, the fund will not pay capital gains tax where assets are sold or transferred to pay their death benefit.

Other measures announced in MYEFO include a reduction in the baby bonus for some (a reduction to $3,000 for second and subsequent births), changes to lost superannuation (with the threshold increased to $2,000) and further tightening of the private health insurance rebate (with reduced indexation and no rebate on lifetime loading).

Interest rates were cut in October to 3.25% with the RBA citing a softer overall outlook both locally and globally as the primary driver. The next decision point is on Melbourne Cup day – a day that the RBA has changed rates every year since 2006. While this is an interesting fact, it does not necessitate a cut.

Nevertheless, it is worthwhile noting that interest rate futures markets are pricing-in a cash rate of between 2.25% and 2.50% by mid 2013. While this may be a touch aggressive, it does reflect the current uncertainty in global markets.

The Australian Dollar was remained strong in October and is currently buying US103.73 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.