The Australian share market gained momentum in November, with the All-Ordinaries index increasing by 3.3% to close the month at 8,669.1 points. The Australian dollar fell by 1.1% over the month, with 1 Australian Dollar currently buying 65.1 United States cents.

The Reserve Bank of Australia (RBA) board kept the Target Cash Rate on hold at 4.35% per annum in November. The next RBA board meeting is scheduled for the second week of December, although no change is expected to interest rates until the New Year.

Global share market returns were mixed in November, with the United States Dow Jones Index gaining by 7.5%, the London FTSE gaining by 2.2%, the Japan Nikkei 225 falling by 2.2%, and the Hong Kong Hang Seng Index falling by 4.9% for the month.

The 2024 United States Presidential election was the key focus in November. President elect Donald Trump and the Republican party had a resounding victory. Markets, in particular in the United States, viewed the result favourably.

Much has been made in the press of President elect Donald Trump’s stated policies, and their potentially detrimental impact to the United States and global economy.

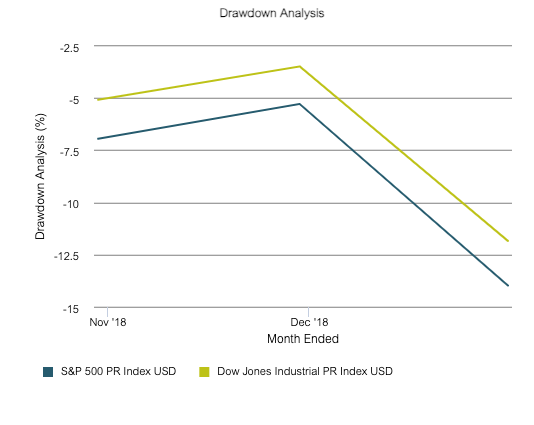

While it is always hard to predict exactly what impact government policy will have on investment markets in the short-term, we can “look back” to the end of 2018 to see how investment markets reacted to stalling United States-China trade talks in President Trump’s first term.

As noted in the chart below, key United States share market indices fell in value by more than 11% from September 2018 to the end of December 2018. This could be indicative of the potential for volatility in the coming months as the new United States President looks to implement his policy platform.

Source: Lonsec iRate

While volatility ought to be expected, it is important to remember that the United States S&P 500 index has more than doubled in value from January 2019 to today’s date, with an annualised rate of return of more than 13% per annum! This return comes despite having experienced a global pandemic, and the associated recession from this.

Given the above, being patient and remaining focused on long-term outcomes more often than not rewards investors well.

If you have questions, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.