The Australian share market took a breather in March, with the All Ordinaries index closing the month down 2.7% at 4,979.9 points. The pull-back was somewhat expected, after a long period of stellar returns.

Global shares were generally well supported in March with the Dow Jones Index gaining 3.7%, the FTSE gaining 0.8% and the Nikkei 225 gaining 7.3%. The Hang Seng once again bucked the global trend, declining 3.1% for the month.

With another corporate reporting season having come to a close, it is worth examining the key themes across companies reporting their performance during the March quarter. Fundamentally, the recurring theme seen across a number of companies was how to remove costs from their business.

Throughout all sectors in the Australian market, revenue growth reported by companies was very weak. Across the total group of companies that reported results for the period, revenue was only up 0.5% (i.e. less than inflation). So clearly it is a tough operating environment.

At the same time, we have seen investors become more optimistic about the share market and growth expectations. The All Ordinaries Index now looks to be either overvalued or at fair value (depending on your outlook for growth).

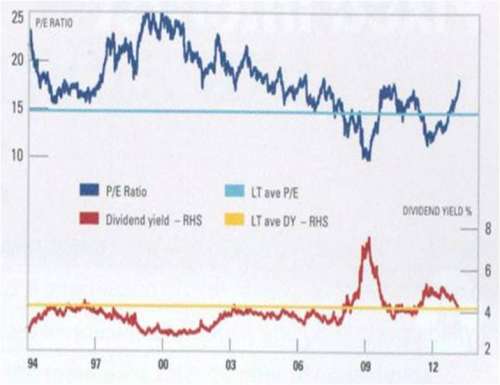

Source: Thomson Reuters

As shown in the above chart, the All Ordinaries Index’s price-to-earnings ratio is above its long-term average and the dividend yield is at around the long-term average. Although there may be less downside risk than last year, investors should be mindful that the below-trend growth isn’t synonymous with the usual bull market cycle.

Within individual sectors of the domestic market, the banking sector delivered very strong results during reporting season. This was highlighted by lower funding costs and better credit quality across the banks. As the banking sector is obviously a large and important one within Australia, the market has rewarded these companies for their results.

Within the resources sector, BHP Biliton and Rio Tinto have had a changing of the guard, with the new CEOs of both companies having been appointed during the most recent reporting period. Interestingly, each has come in with a focus on costs and capital allocation discipline, but seemingly with much less (or even no) focus on growth.

To international news, Cyprus is the latest European nation to come under focus. The collapse of the island nation's financial system could lead to Cyprus' exit from the eurozone.

Lawmakers in Cyprus are working to pass a plan that would allow it to receive a bailout from the European Union and IMF to prop up its ailing banks. There are several proposals on how the small island nation will come up with the 5.8 billion euros they need, but it is not clear that any one plan has the support of parliament.

A government spokesman said that the future of the country will be decided in the "next few hours". If the government can't come up with a credible plan, the European Central Bank will pull its emergency liquidity and the banks will fail.

The RBA board kept rates on hold in March at 3.00% per annum. The RBA board meet again today to assess interest rates, with most economists expecting rates to remain on hold for the foreseeable future.

The Australian Dollar increased 2.3% in February and is currently buying US104.38 cents.

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.