The Australian share market was down in June with the All Ordinaries index falling 2.8% to close the month at 4,775.4 points. The poor performance comes on the back of a 4.9% fall in May. Notwithstanding the recent pull-back, the Australian share market still recorded a very strong financial year, gaining more than 15%.

Global shares also finished June in negative territory with the Dow Jones Index falling 1.4%, the FTSE falling 5.6%, the Hang Seng falling 7.1% and the Nikkei 225 falling 0.7%.

The poor market sentiment was driven largely by a monetary policy statement from the US Federal Reserve (the RBA of the US) with respect to its plans to progressively withdraw its market stimulus package – dubbed QEII (a program of buying bonds to support financial market liquidity).

The US Federal Reserve monetary policy statement contained nothing alarming. However, in the associated press conference, Chairman Ben Bernanke stated that the stimulus program would most likely be ‘tapered’ in late-2013 and closed in mid-2014 (contingent on expectations around US unemployment being met).

Global markets had a sharp reaction to the press conference remarks. While it was expected that the stimulus program would eventually be wound down, the cessation altogether by mid-2014 was new information. Clearly, the US Federal Reserve has learnt from previous mistakes when stimulus was left in place too long and asset bubbles developed.

It is fair to say that the easing and ultimate cessation of QEII will lead to higher bond yields in the US. This will not only impact the US housing market (via higher mortgage rates), but it will also see the US currency appreciate (noting that this has already happened over the past two months with the Australian dollar currently buying US102.77 cents).

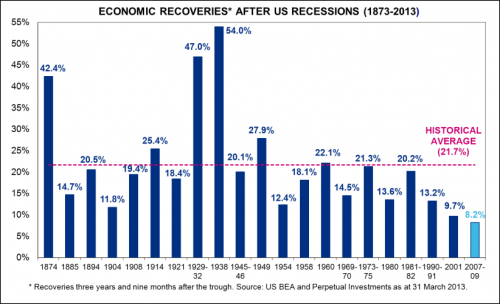

Although the Fed is looking to cease its stimulus program, it should be noted that the US economic recovery remains the weakest in history as illustrated in the chart below.

Source: Perpetual

Even though the US economic recovery has been weak by historical comparison, the US share market has continued to rise. This rise is on the back of marginal gains in US corporate earnings. However, as noted in previous monthly newsletters, the earnings mainly stem from large scale cost cutting by US corporations, rather than revenue growth.

China has always been seen as the ‘beacon’ of economic growth throughout the global financial crisis and protected Australia from the worst of the global downturn. However, more recently the explosion of credit in China has caused some concerns within the Chinese financial system (with short-term rates surging as banks struggle to obtain funding in short-term money markets). This all appears to be part of a plan by the Chinese authorities to constrain liquidity and reduce credit growth.

China is still recording economic growth of over 6% per annum (a dream result for any developed economy) and the closed nature of the Chinese financial system makes a financial crisis in China next to impossible. Given this, I don’t see a real risk of the Chinese economy ‘grinding to a holt’. Rather, a managed reduction to economic growth in China is more likely.

Added to the mix of issues for Australian investors to digest is the laughable political landscape in Australia. June was another remarkable month in Australian politics with Kevin Rudd reinstated as prime minister along with a reshuffle to key ministerial positions including Treasurer. Political uncertainty has long been a drag on the Australian investment landscape (with the Australian shares underperforming global shares) and the latest developments do little to ease investor concerns.

The key takeouts for investors are to expect the Australian dollar to continue to depreciate relative to the US dollar when/if the US Federal Reserve winds back its stimulus package, favour actively managed portfolios (where investment selection is quantitative based and includes exposure to international assets) and to expect the RBA to be under continued pressure to cut interest rates (with another cut likely before Christmas).

For more information please contact Ryan Love on 1300 856 338 or e-mail ryan.love@apexpartners.com.au.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation and investment objectives.