The Australian share market retreated in value in December, with the All-Ordinaries index falling by 6.2% to close the month (and 2024 calendar year) at 8,159.1 points. The Australian dollar fell sharply, falling by 4.5% during the month, with 1 Australian Dollar currently buying 62.2 United States cents.

The Reserve Bank of Australia (RBA) board kept the Target Cash Rate on hold at 4.35% per annum in December. The next RBA board meeting is scheduled for mid-February.

Global share market returns were mixed in December, with the United States Dow Jones Index falling by 5.3%, the London FTSE falling by 1.4%, the Japan Nikkei 225 gaining by 4.4%, and the Hong Kong Hang Seng Index gaining by 2.6% for the month.

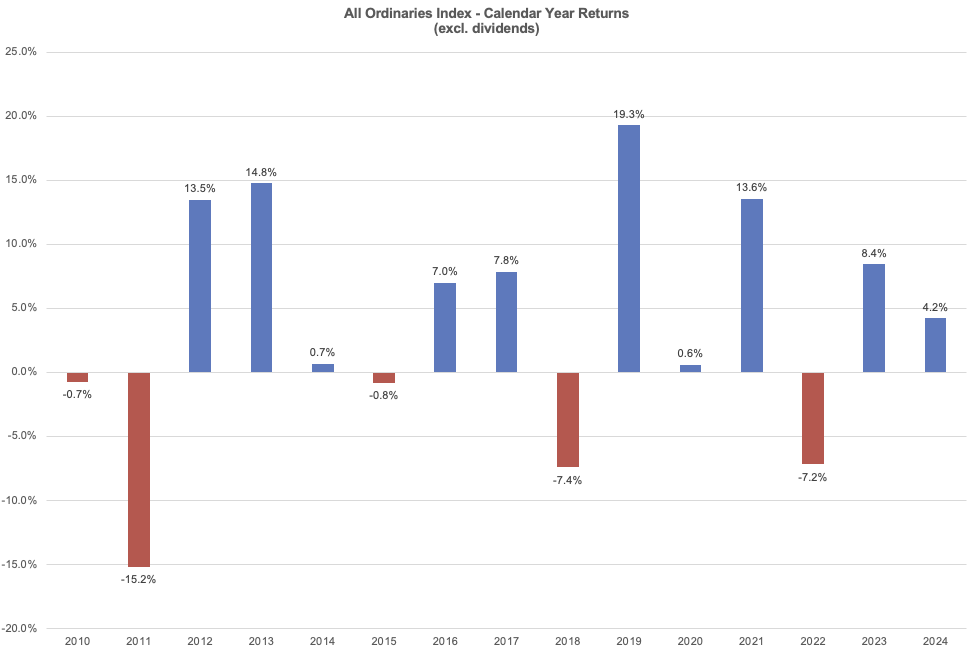

The chart below shows the annual calendar year price return in the All-Ordinaries index from 2010 to 2024.

Source: Yahoo Finance, Apex Partners

As noted in the above chart, the positive year in 2024 follows another positive year in 2023. Looking back over the past 15 years, there have been 10 positive return years, and 5 negative return years for the All-Ordinaries index.

The key to successful investing is to recognise that there is generally double the amount of positive return years compared with negative return years – and not to change philosophy as investment markets experience a downturn.

As I noted in last month’s newsletter, investment markets will no doubt be volatile as we enter 2025. Provided interest rates come down, and United States President elect Donald Trump is consultative when implementing his policy platform, there is a good chance that investment markets will once again reward investors in 2025.

If you have questions, please contact Ryan Love on 1300 856 338.

This article is general information only and is not intended to be a recommendation. We strongly recommend you seek advice from your financial adviser as to whether this information is appropriate to your needs, financial situation, and investment objectives.